CRU data for 2020 confirms downwards trend in injury claims. ACSO says: Insurers should hand back £35 savings now

The latest data from the government’s Compensation Recovery Unit (CRU) confirms a significant drop in injury claims during 2020. Following an FOI request, the Association of Consumer Support Organisations (ACSO), found that 172,000 injury claims were registered in Oct–Dec 2020, a drop of almost 50,000 compared to the same period in 2019. Motor injury claims, which make up the most significant proportion of claims on the database, fell to just under 140,000, a 23% year-on-year fall.

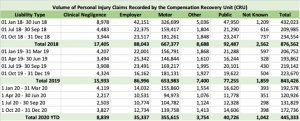

Looking at the whole year, the CRU reported a 47% drop in claims across all categories (motor, EL, PL and clinical negligence), from just over 843,000 to just over 445,000. Motor saw a 46% fall, to just under 356,000. Unsurprisingly, the biggest drop in claims was in Employer Liability, which recorded a 60% fall year-on-year between 2019 and 2020, mainly due to the effect of the pandemic and more people working remotely.

Commenting on the data, Matthew Maxwell Scott, executive director of ACSO, said: “The picture that emerges from last year is of a hugely significant fall in all personal injury claims. Covid has achieved over the course of 12 months what the government set out to do with its compensation reform programme.”

Mr Maxwell Scott said that such a significant fall in claims would bring about a large boost to insurer profits, meaning there was “no reason at all why consumers should not get their promised £35 reduction in motor insurance premiums now.”

Admiral’s return of £25 to policy holders last year underlined that motor insurers have done very well out of the pandemic, and it seems fair that consumers should benefit. Maxwell Scott noted the latest ABI statistics which showed that car insurance had fallen by just 1% between 2019-2020, to an average premium of £465. (i)

“Consumers should expect a much more substantial reduction in their premium than £4.65, so we urge insurers to do the right thing by Britain’s drivers and meet or beat what Admiral has done.

“The ABI estimates that the average bodily injury claim pay-out is £10K (ii), so broadly speaking motor insurers have collectively saved £29bn in 2020 from a near 50% reduction in motor injury claims alone.”

Looking ahead, Mr Maxwell Scott said the government should hold off on pressing ahead with reforms to EL and PL claims in light of the sharp drop in incidence during 2020.

“Managing such fundamental changes to the RTA regime is a major task that will consume a lot of resources for all industry stakeholders, not just our members. Even more importantly we need to learn from these changes and impact assess them once the new regime has matured to then ensure any future changes are implemented effectively.”

“We argue that ministers should await the outcome of the first tranche of reforms, and have an eye to longer-term reductions in claims incidence, before ploughing ahead with planned changes to EL and PL, especially in view of the continuing pandemic and the chaos it is causing in civil justice.”

DWP Compensation Recovery Unit Personal Injury Data for the Period Jan 2018- Dec 2020

Sources:

Related

You might also like:

-

Posted 13 May

Modern Insurance Magazine Issue 53 Now Available

The latest issue of Modern Insurance Magazine is now available to view, to check it out click on the image below.

Read more -

Posted 18 January

Roundtable event shines a spotlight on salvage

Copy provided by e2e Total Loss Vehicle Management

Read more -

Posted 11 January

Experian Partner on Unique Initiative to Enhance Customer Experience and Insurer Risk Data

LONDON: Thursday 6th January 2022 – Duck Creek Technologies (Nasdaq: DCT) announced today that it has entered into a partnership with global information services company Experian which will help general insurance providers in the U.K. market to enhance the quality of their underwriting and claims handling, delivering more detailed risk profiles through enhanced consumer data. The partnership will deliver an on-demand Software as a Service (SaaS) solution using Experian’s iCache platform – which integrates critical and accurate risk information during the underwriting process for motor, buildings, and contents insurance.

Read more